Getting The Hsmb Advisory Llc To Work

Wiki Article

Indicators on Hsmb Advisory Llc You Need To Know

Table of ContentsThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingHsmb Advisory Llc for BeginnersAn Unbiased View of Hsmb Advisory LlcHsmb Advisory Llc for Beginners

Life insurance coverage is especially vital if your household hinges on your income. Market specialists suggest a plan that pays 10 times your annual revenue. When approximating the amount of life insurance you need, consider funeral service expenditures. Then compute your family's day-to-day living costs. These might include mortgage repayments, impressive finances, charge card financial obligation, taxes, day care, and future university prices.Bureau of Labor Data, both spouses worked and brought in revenue in 48. They would certainly be most likely to experience economic difficulty as an outcome of one of their wage earners' fatalities., or personal insurance you acquire for yourself and your family by speaking to wellness insurance policy business straight or going through a health insurance coverage agent.

2% of the American populace lacked insurance policy protection in 2021, the Centers for Condition Control (CDC) reported in its National Center for Health And Wellness Statistics. Greater than 60% obtained their insurance coverage with an employer or in the private insurance industry while the remainder were covered by government-subsidized programs including Medicare and Medicaid, veterans' benefits programs, and the federal market established under the Affordable Treatment Act.

Hsmb Advisory Llc Things To Know Before You Buy

If your income is low, you might be one of the 80 million Americans that are qualified for Medicaid.According to the Social Security Management, one in four employees getting in the labor force will certainly become impaired prior to they get to the age of retirement. While wellness insurance coverage pays for a hospital stay and clinical costs, you are typically burdened with all of the costs that your income had covered.

This would be the very best option for securing budget friendly handicap insurance coverage. If your employer doesn't use lasting insurance coverage, below are some things to think about prior to acquiring insurance policy by yourself: A plan that guarantees earnings substitute is optimal. Several policies pay 40% to 70% of your income. The cost of impairment insurance is based on lots of factors, consisting of age, way of life, and health.

Numerous plans call for a three-month waiting duration prior to the coverage kicks in, give an optimum of 3 years' worth of protection, and have considerable policy exclusions. Right here are your alternatives when buying vehicle insurance coverage: Obligation insurance coverage: Pays for residential or commercial property damage and injuries you cause to others if you're at fault for a mishap and additionally covers litigation expenses and judgments or settlements if you're filed a claim against due to the fact that of a vehicle mishap.

Comprehensive insurance covers theft and damage to your vehicle due to floods, hail, fire, vandalism, falling items, and animal strikes. When you fund your vehicle or rent an auto, this sort of insurance coverage is necessary. Uninsured/underinsured driver () insurance coverage: If an uninsured or underinsured motorist strikes your vehicle, this protection pays for you and your passenger's medical expenditures and may also account for lost revenue or compensate for discomfort and suffering.

Employer coverage is usually the most effective choice, however if that is unavailable, obtain quotes from numerous providers as numerous give discounts if you buy greater than one sort of insurance coverage. (https://www.intensedebate.com/people/hsmbadvisory)

A Biased View of Hsmb Advisory Llc

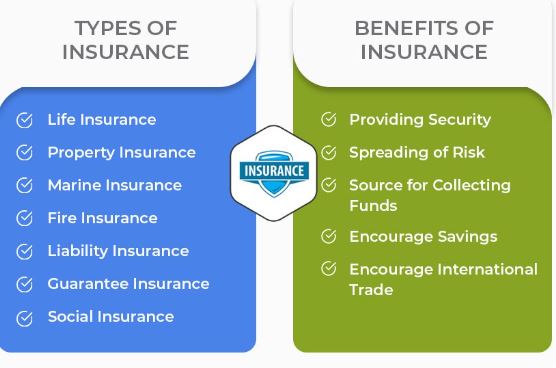

Between wellness Click This Link insurance coverage, life insurance, special needs, liability, lasting, and even laptop insurance coverage, the job of covering yourselfand thinking of the unlimited possibilities of what can occur in lifecan really feel frustrating. As soon as you recognize the fundamentals and make sure you're properly covered, insurance coverage can increase financial self-confidence and health. Right here are one of the most vital sorts of insurance you require and what they do, plus a pair ideas to stay clear of overinsuring.Various states have different policies, however you can expect wellness insurance coverage (which lots of people get via their employer), vehicle insurance policy (if you possess or drive a lorry), and homeowners insurance (if you have home) to be on the list (https://www.metal-archives.com/users/hsmbadvisory). Obligatory kinds of insurance policy can alter, so look into the most recent legislations every now and then, specifically before you renew your policies

Report this wiki page